Last week, Indian cotton yarn prices stabilized, and blended yarn prices fell slightly. The depreciation of the rupee and the appreciation of the renminbi could stimulate cotton yarn exports to China.

Supported by the CCI acquisition, cotton prices in India have stopped falling and remained high, stabilizing in the vicinity of MSP as a whole. Textile mills are in strong demand for imported cotton, and the US agriculture counselors expect India will use more cotton this year, so cotton production will continue to increase.

Indian cotton yarn exports largely depend on changes in cotton prices and domestic currency exchange rates. Affected by the rebound in the Indian rupee exchange rate in December 2018, Indian cotton yarn exports fell sharply, by more than 20 percent year-on-year, and by 45 percent to China. Exports to Pakistan fell 28% and exports to Bangladesh increased.

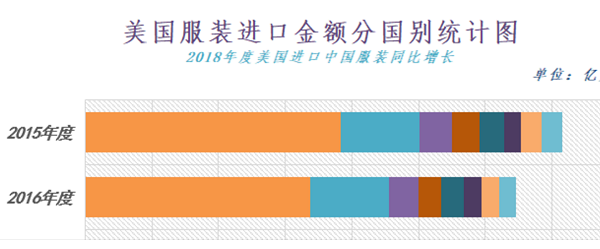

Indian cotton yarn exports rose 10.6 percent year-on-year in 2018 as exports performed well when the rupee fell in the first half of last year. A rebound in the yuan and another fall in the Indian rupee are expected to boost India's cotton yarn exports to China. The slowdown in China's economic growth and the decline in garment exports have affected demand for cotton yarn imports.

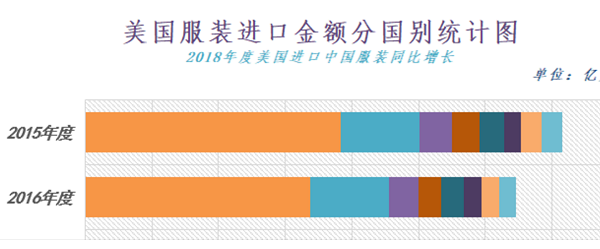

The trade negotiations between China and the United States have an important impact on the trend of cotton prices. First, the United States is the largest exporter of textile and clothing in China. The second is that the development of cotton textile industry can not be separated from the improvement of macro-environment. If the negotiations between the two sides do not achieve positive results, the market will certainly make the market have some worries about the prospects of China's economic development in the future. Of course, we should not pay too much attention to the impact of Sino-US trade negotiations on cotton prices, the balance of cotton supply and demand are also important.

At this stage, the impact of Sino-US trade negotiations on cotton prices should not be considered too much. With the increase of production cost, the cost advantage of cotton spinning and garment industry in China is gradually shrinking, and its share in the world garment market is also shrinking, and it is an irreversible trend. From this point of view, future cotton consumption should be at best stable, hoping for a substantial increase in consumption is unrealistic.

Since June 2018, global cotton prices have been under pressure due to the overall weakening of global cotton prices. Compared with 2017 / 18, the global supply of long-staple cotton has increased significantly this year. Since the fourth quarter of 2018, long-staple cotton consumption has also begun to weaken, and this year's production of long-staple cotton may exceed consumption of 290000 bales.

India is the largest consumer of long-staple cotton, consuming close to 750000 bales of cotton this year. China produces about 275000 bales of long-staple cotton, and consumption is expected to be 690000 bales, accounting for about 1 / 3 of global consumption. Egypt produces 500000 bales of long-staple cotton, of which Giza 94 and Giza 86, the US's main competitors, produce more than 410000 bales.

This year, India was Egypt's biggest buyer of long wool cotton. So far, India has imported 169600 bales of American pimp cotton this year, up from 152800 bales a year earlier.